schb expense ratio|schb stock dividend : Manila SCHB – Schwab US Broad Market ETF™ – Check SCHB price, review total assets, see historical growth, and review the analyst rating from Morningstar. Resultado da Anatomia humana é o campo da biologia responsável por estudar a forma e a estrutura do organismo humano, bem como as suas partes. O nome anatomia origina-se do .

0 · schwab etf expense ratio

1 · schb stock split

2 · schb stock dividend

3 · schb etf fact sheet

4 · schb etf dividend yield

5 · schb dividend yield

6 · schb dividend history

7 · schb dividend date

8 · More

web7M Followers, 101 Following, 792 Posts - See Instagram photos and videos from corinna kopf (@corinnakopf)

schb expense ratio*******SCHB is an ETF that tracks the Dow Jones U.S. Broad Stock Market Index, with a low expense ratio of 0.030%. It offers potential tax-efficiency, diversification and access to 2,500 largest U.S. companies.

SCHB – Schwab US Broad Market ETF™ – Check SCHB price, review total assets, see historical growth, and review the analyst rating from Morningstar.

Learn everything you need to know about Schwab US Broad Market ETF™ (SCHB) and how it ranks compared to other funds. Research performance, expense .

Find the latest Schwab U.S. Broad Market ETF (SCHB) stock quote, history, news and other vital information to help you with your stock trading and investing.

Gross Expense Ratio: 0.03% Tax-adjusted returns and tax cost ratio are estimates of the impact taxes have had on a fund. Assumes the highest tax rate in .

From an expense perspective, SCHB is one of the cheapest options out there, and the option to trade this fund commission free in Schwab accounts further . Schwab reduces expense ratios on 15 ETFs SAN FRANCISCO (MarketWatch) -- Charles Schwab Corp. said Friday it reduced operating expense ratios .Information regarding "Fees & Expenses" and "Investment Minimums" generally applies to retail investment accounts as well as Personal Choice Retirement Accounts (PCRA). .

It seeks investment results that track performance, before fees and expenses, of the approximately 2,500-stock Dow Jones U.S. Broad Stock Market Index. Charles Schwab is a one-stop shop for all types of investors. Savvy DIY investors love searching for index funds and ETFs that offer low expense ratios. And Charles Schwab's offerings are some of the most . See the Performance tab for updated monthly returns. Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by calling 800-435-4000. SCHB’s expense ratio of .03% is among the lowest of any total market funds. Even if another fund is free, three basis points is not a material difference in my opinion. SCHB Transaction Costs. ETFs are free to trade at many brokers and custodians, so SCHB should be free to trade in most cases. Additionally, it is among the largest . One of the best qualities of SCHB and compared total market ETFs is their ultra-low expense ratios. With an expense ratio of 0.03%, SCHB is on par with other broad market ETFs examined.

Gross Expense Ratio 0.03% Net Expense Ratio 0.03% A net expense ratio lower than the gross expense ratio may reflect a cap on or contractual waiver of fund expense. Please read the fund prospectus for . SCHB$30,436 Large Blend$26,382 DJ US Broad Stock Market TR USD$30,458 Tax Analysis Data as of 04/30/2024

SCHB's expense ratio and number of holdings are lower compared to its peers, but it may have positive investor sentiment and inflows. Despite SCHB being relatively overvalued vs. the S&P500 Index .

Net Expense Ratio * 0.03: Turnover % 4 * Expense ratio updated annually from fund's year-end report. . No news for SCHB in the past two years. Fund Details. Fund Details. Net Assets 28.42 B. NAVschb expense ratio schb stock dividend First of all, from a cost standpoint, SCHB is a very efficient core holding. With a rock-bottom expense ratio of .03%, SCHB matches up directly with VTI and ITOT, the major competitors I .

The Schwab U.S. Broad Market ETF (SCHB) is an exchange-traded fund that is based on the Dow Jones US Broad Stock Market index. The fund tracks a cap-weighted index of the largest 2,500 stocks in the US. SCHB was launched on Nov 3, 2009 and is issued by Charles Schwab. Asset Class Equity. SCHB Price - See what it cost to invest in the Schwab US Broad Market ETF™ fund and uncover hidden expenses to decide if this is the best investment for you.schb stock dividend SCHX vs. SCHB - Expense Ratio Comparison Both SCHX and SCHB have an expense ratio of 0.03% , making them cost-effective options compared to the broader market, where average expense ratios typically range from 0.3% to 0.9%.Schwab US Broad Market ETF™ (SCHB) 63.03-0.10 (-0.16%) USD | NYSEARCA | Jun 21, 16:00 . Net Expense Ratio Discount or Premium to NAV Total Assets Under Management 30-Day Average Daily Volume . Its expense ratio of 0.03% is perfect for beginner investors. Still, its exposure to small- and mid-cap stocks is minimal and won't result in much more diversification than an S&P 500 Index ETF .

ETF Expense Ratio. Expense Ratio: 0.03%: Dividend (Yield) $0.80 (1.28%) Issuer: CHARLES SCHWAB: SCHB External Home Page. Benchmark for SCHB DOW JONES US BROAD STOCK MARKET INDEX.

schb expense ratio Expense Ratio. VTI and SCHB both have an expense ratio of 0.03%. This is about the lowest ratio you will find on any ETF in the entire industry. One reason both funds are able to offer fees this low is that there is very little administrative labor involved in the upkeep and maintenance of the fund since its composition does not really change .

Schwab US Broad Market ETF™ (SCHB) 63.03-0.10 (-0.16%) USD | NYSEARCA | Jun 21, 16:00 . Net Expense Ratio Discount or Premium to NAV Total Assets Under Management 30-Day Average Daily Volume . Its expense ratio of 0.03% is perfect for beginner investors. Still, its exposure to small- and mid-cap stocks is minimal and won't result in much more diversification than an S&P 500 Index ETF .

ETF Expense Ratio. Expense Ratio: 0.03%: Dividend (Yield) $0.80 (1.28%) Issuer: CHARLES SCHWAB: SCHB External Home Page. Benchmark for SCHB DOW JONES US BROAD STOCK MARKET INDEX. Expense Ratio. VTI and SCHB both have an expense ratio of 0.03%. This is about the lowest ratio you will find on any ETF in the entire industry. One reason both funds are able to offer fees this low is that there is very little administrative labor involved in the upkeep and maintenance of the fund since its composition does not really change .SCHB is a fund that delivers well-balanced exposure to the US equity market. The fund tracks the Dow Jones US Broad Stock Market Index, and SCHB's limited optimization of its index does not result in any material portfolio differences. Indeed, the fund's average market cap, industry weightings and fundamental ratios are essentially the same as .Expense ratio is the fund’s total annual operating expenses, including management fees, distribution fees, and other expenses, expressed as a percentage of average net assets. . SCHB - Expenses Operational Fees. SCHB Fees (% of AUM) Category Return Low Category Return High Rank in Category (%) Expense Ratio 0.03% 0.01% 19.75% . SCHK vs. SCHB - Expense Ratio Comparison. SCHK has a 0.05% expense ratio, which is higher than SCHB's 0.03% expense ratio. However, both funds are considered low-cost compared to the broader market, where average expense ratios usually range from 0.3% to 0.9%. SCHK.

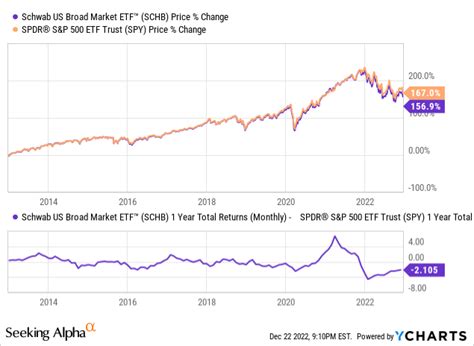

SCHB's expense ratio of 0.03% is significantly lower than SPY's 0.1%. YCharts. Is SCHB's valuation attractive? There are many ways that we can evaluate SCHB's valuation. One is to look at stocks .

See the company profile for Schwab U.S. Broad Market ETF (SCHB) including business summary, industry/sector information, number of employees, business summary, corporate governance, key executives .

screener.fidelity.com

SCHB vs. VOO - Expense Ratio Comparison Both SCHB and VOO have an expense ratio of 0.03% , making them cost-effective options compared to the broader market, where average expense ratios typically range from 0.3% to 0.9%.

WEB22 de jan. de 2024 · Flamengo x Cruzeiro se enfrentarão em uma partida que está marcada para acontecer no dia de hoje, segunda-feira (22). A partida envolvendo esses dois grandes times será realizado pela semifinal da Copa São Paulo.A disputa envolvendo essas equipes está marcada para iniciar às 19h30 (horário de Brasília). O jogo está .

schb expense ratio|schb stock dividend